Key Takeaways

- The magnitude of the launch of Rufus is yet to be defined, and Flywheel is studying and tracking the impact on the future of how consumers search. We closely studied the Amazon search algorithm for years and plan on doing the same with Rufus.

- Right now, accuracy in your written content is critical. This is what is training the Language Learning Model fueling Rufus in determining what products are shown to customers.

- We anticipate the ad metrics that matter for brands to continue to shift away from above the fold share of voice and organic rank to metrics such as new customer acquisition, lifetime value, and path to purchase (all visible through AMC) as Rufus is likely to contribute to a mass adoption of a more customizable, discovery-driven era of search.

What we know about Rufus

"Rufus is an expert shopping assistant trained on Amazon’s product catalog and information from across the web to answer customer questions on shopping needs, products, and comparisons, make recommendations based on this context, and facilitate product discovery in the same Amazon shopping experience customers use regularly.” - Amazon post

Rufus launched in beta last week to a small subset of mobile app users as a dialogue box that appears after customers have searched (overlaying traditional search results) that will produce customized specific product results, with plans to roll out to additional customers in the coming weeks. Trained on both Amazon data and open data from the web, Rufus allows the customer to:

- Conduct general research (like “what to look for when shopping for X” questions)

- Shop for occasion or purpose

- Compare categories

- Ask about specific products (answers generated based on listing details, customer reviews and community Q&A)

“Online marketplaces with infinite shelf space need to innovate constantly to provide better ways for customers to find high quality and relevant products. The way that traditional search operates is limiting in this regard, and generative AI is a great way to provide comparisons and recommendations.” - Keerat Sharma, CTO

What we think of Rufus so far

While it’s impossible to know the exact weighting of what’s influencing the LLM fueling Rufus, we have some initial recommendations for understanding the immediate impact of Rufus.

In addition to catalog fundamentals, PDP Content is pivotal in understanding the power of Rufus

“It’s clear that Amazon’s use of ratings and reviews to build trust from shoppers has been pivotal in amassing large amounts of human generated, unique training data for the LLM.” - Gabe Fishbein, VP Product

From what we can tell, image content seems to be absent from the training set for Rufus (for now). Images remain important for driving clickthrough and conversion but don’t have a relevant play here, which means that written content is critical in educating both customers and the LLM.

With this in mind, brands must ensure that written content is accurate, up to date, and descriptive, because not only is written content educating consumers, it’s training the LLM to better serve customer inquiries.

How will Rufus impact ads and the search algorithm?

Although it’s unclear how ads tie into the LLM, it seems that the underlying principles of ‘winning in AI search’ should more or less remain the same as winning in traditional search. This ties into the earlier point, as traditional search efficiencies are built off of a catalog that’s retail ready to assist customers in making informed decisions.

What this means for the user experience and measuring path to purchase

From the video shared in Amazon’s blog post of Rufus in action, we see that consumers don’t have to stay within the traditional search results or within Rufus. They have the choice to pick from multiple paths to final conversion, which means that the ever-expanding possibilities for paths to purchase will need further iterations in how we measure.

For example, if a shopper sees a Sponsored Product ad, then asks Rufus a question, then goes back to traditional search, clicks an SP ad, and converts - the number of unique paths becomes exponentially larger and it makes multi-touch attribution that much more muddy.

What we anticipate

As we look to the future of search with customers shifting to discovery-based searching / conversing with chatbots, we anticipate ads to be layered into Rufus. This will only escalate the shift away from ATF SOV or organic rank as key metrics for success.

AI search drives personalization, accelerates shift from SOV as key metric

With mass adoption of Rufus, customers would be discovering products based on conversation vs traditional searching and scrolling, which changes what metrics brands look to as their KPIs for search advertising. Rufus may become an entirely new search experience within itself.

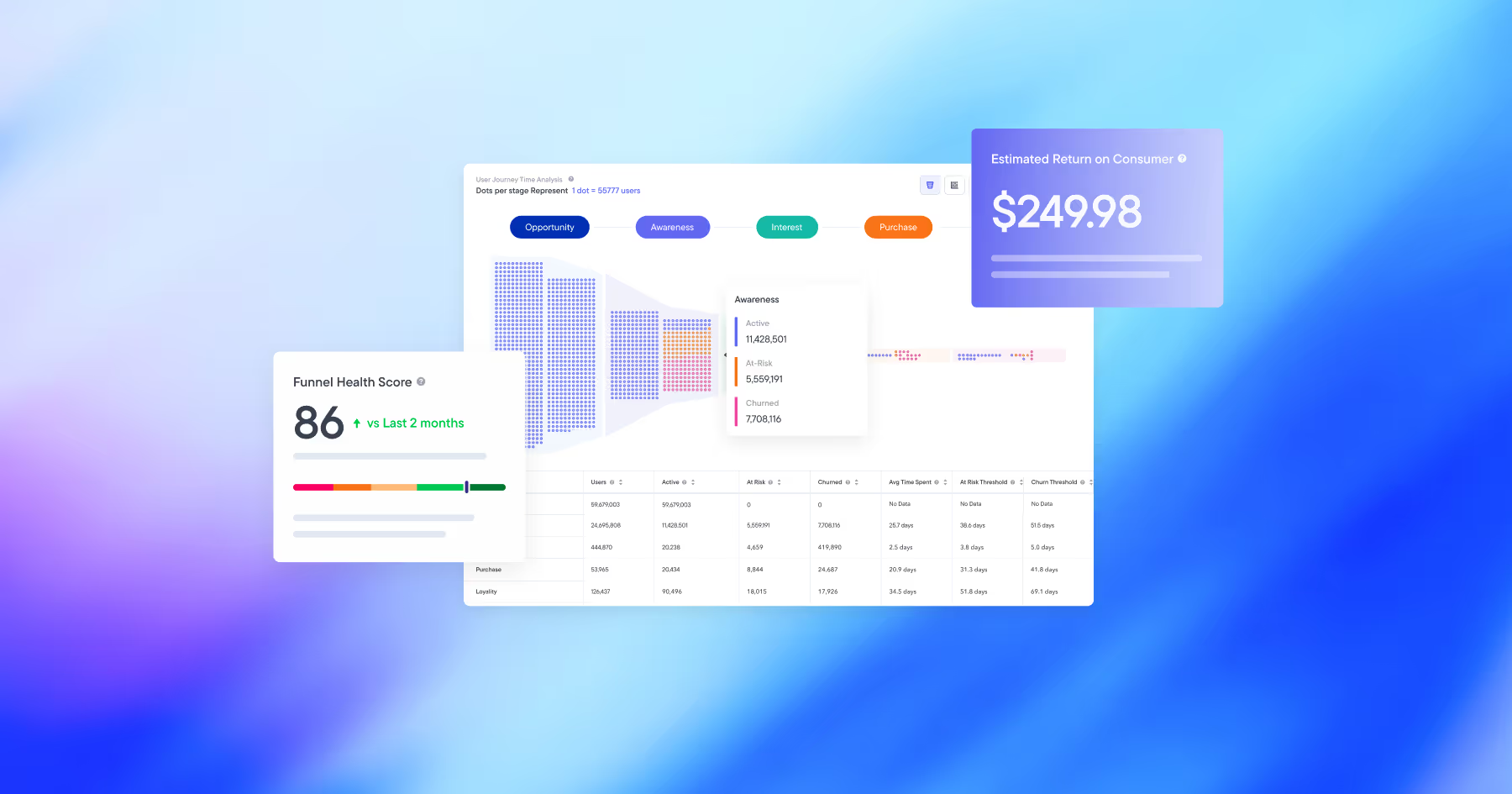

Beyond personalized results, customers can now have private conversations with LLMs to find products, nearly eliminating the significance of an SOV score driven by a single scrape on a single IP at a single moment. This requires beginning to think about how you measure beyond share of search/voice metrics. This leads us more to metrics like Long Term Value (LTV), New to Brand acquisition, and path to purchase measurement. With this shift in what metrics brands should prioritize, utilization of AMC becomes a requirement.

“We see great potential in having generative AI understand nuanced preferences that a customer has based on prior products purchased/browsed and the search terms they use.” - Keerat Sharma, CTO

Rufus is providing critical product insights during the discovery phase

Currently, brands can understand customers' questions about their products AFTER they have already bought them through reviews. This insight informs potential changes in product titles, bullets, images, packaging, etc.

Now Rufus gives brands a similar insight while consumers are in the discovery phase. If brands can understand in aggregate how NTB shoppers are asking about products, it could be a huge opportunity to get ahead of crucial product changes.

Overall, we’re excited to study how Rufus (and other AI-driven search experiences such as the one recently released by Walmart) will change how search operates, how we understand the metrics that matter, and how we build full ecommerce strategies for the future.

“We're excited about innovation that helps customers find relevant products to buy, because that's what we help our clients with also.” - Keerat Sharma, CTO

Ready to grow your business?

Let’s discuss the best approach to meet your brand’s specific needs.

Let's connect